The unilateral insurance definition is an. A unilateral contract is commonly formed in a number of cases.

Insurance 3 Insurance Contract And Insurance Companys Operations

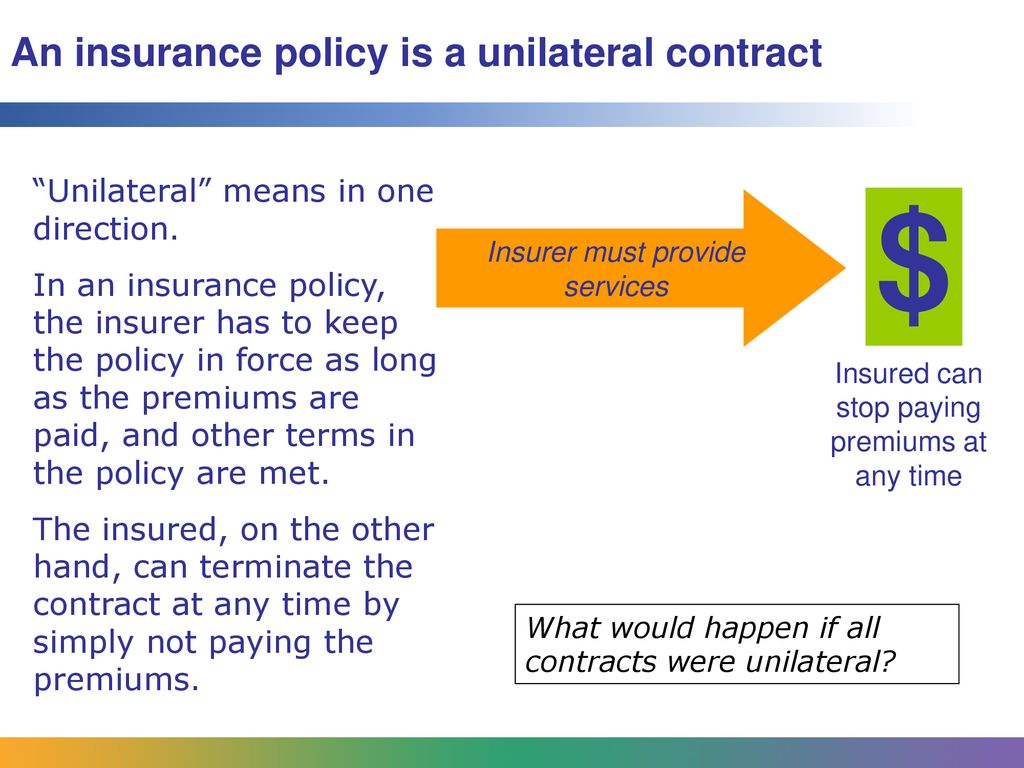

In the case of a unilateral contract only the tenderer has an obligation.

. When it comes to a unilateral agreement only one party pays the. You agree to some stipulations such as truthfully answer the application questions and pay the premium. Bilateral contracts is the number of parties involved.

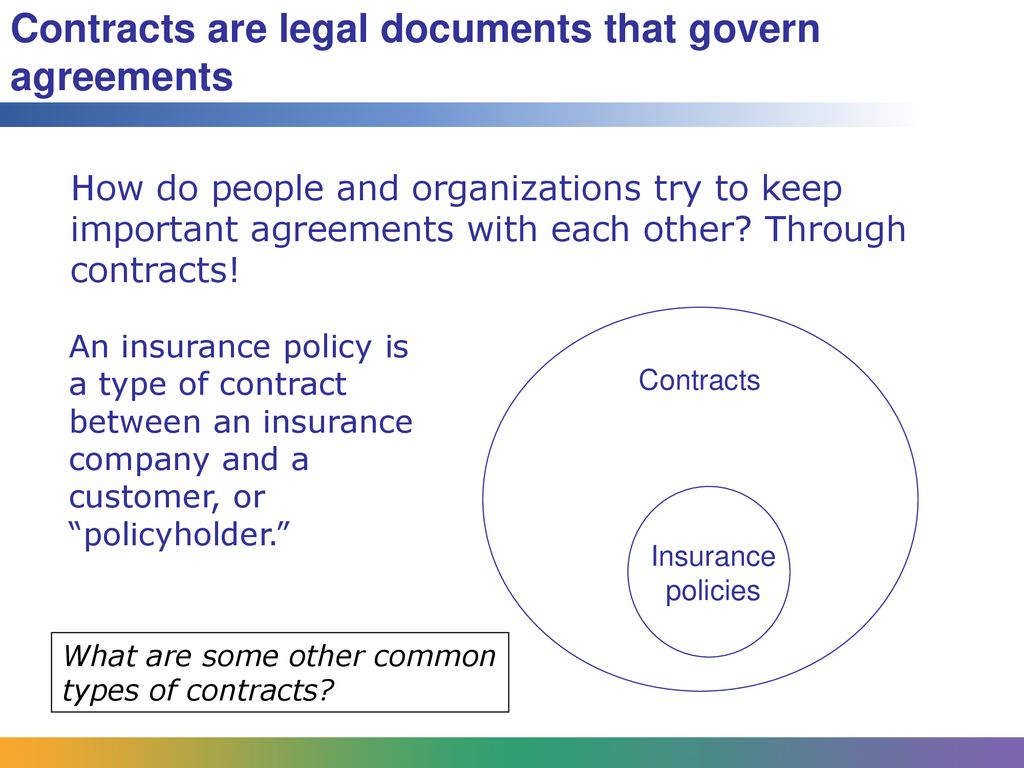

Depending on the chosen program you can partially or completely protect yourself from unforeseen expenses. The most obvious difference between unilateral vs. An insurance policy is a contract of adhesion between you and the insurance company.

Instead the insured must only fulfill certain conditions such as. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims. Answer 1 of 5.

Unilateral contract refers to a promise of one party to another that is legally binding. The assigned policy is only legally binding with the written consent of the insurance company. Each of the parties in a bilateral contract are simultaneously obligors owing another party the performance of some act and obligees those owed the performance of some act from another.

A unilateral contract refers to an agreement enforceable by the Indian Contract Law in which one party promisor promises to reward another party acceptor for performing a specific act. Unilateral contract insurance and risk reduction. Rather the insured simply pays a premium on the policy.

They decide to take life insurance policies out on each other and name each other as beneficiaries. Enforcing Bilateral or Unilateral Contracts in Court. If you need examples of unilateral contracts you should know that a unilateral contract is one in which the buyer intends to pay for a specified performance or legal act.

Compare the provisions of articles 672 673 660 of the Commercial Code Contracts can be unilateral or bilateral. Only the insured can change the provisions C. To be calm and protected you can use the unilateral contract insurance.

Most insurance contracts are. Eventually they retire and dissolve the business. To form the contract the party making the offer called the offeror makes a promise in exchange for the act of performance by the other party.

And if the accident insurance event occurs the. The insurance company agrees to be bound by the conditions of the insurance policy w. Read on to discover the definition of the term Unilateral - to help you better understand the language used in insurance policies.

Unilateral Contract a contract in which only one party makes an enforceable promise. On the other hand bilateral contracts need at least two parties to negotiate agree and act upon a promise. Can a policy holder have both paper and electronic policies.

It differs from a bilateral contract. Distinguishing characteristic of an insurance contract in that it is only the insurance. Insurance policies are usually unilateral agreements.

The offer can only be accepted when the other party completely performs the requested action. A unilateral contract is a contract created by an offer that can only be accepted by performance. Unilateral contract insurance is a tool to reduce your risks.

Insurance policies are one of the most common places to find characteristics of a unilateral contract. A contract such as an insurance contract in which only one of the parties makes promises that are legally enforceable. Unilateral contracts rely on only one party to create a contract or promise for a specified or general group of people.

A contract in which only one party makes an enforceable promise. An insurance policy contract which is frequently partially unilateral is an example of a unilateral contract. - to help you better understand the language used in insurance policies.

In a bilateral agreement both parties agree on an obligation. By contrast the insured makes few if any enforceable promises to the insurer. The contract is deemed accepted when the offeree agrees to complete the requested task.

An insurance contract is a unilateral contract because the insurer promises coverage to the insured when the former recognizes the latter as an official policyholder. Get a Quote. Only the insurer is legally bound.

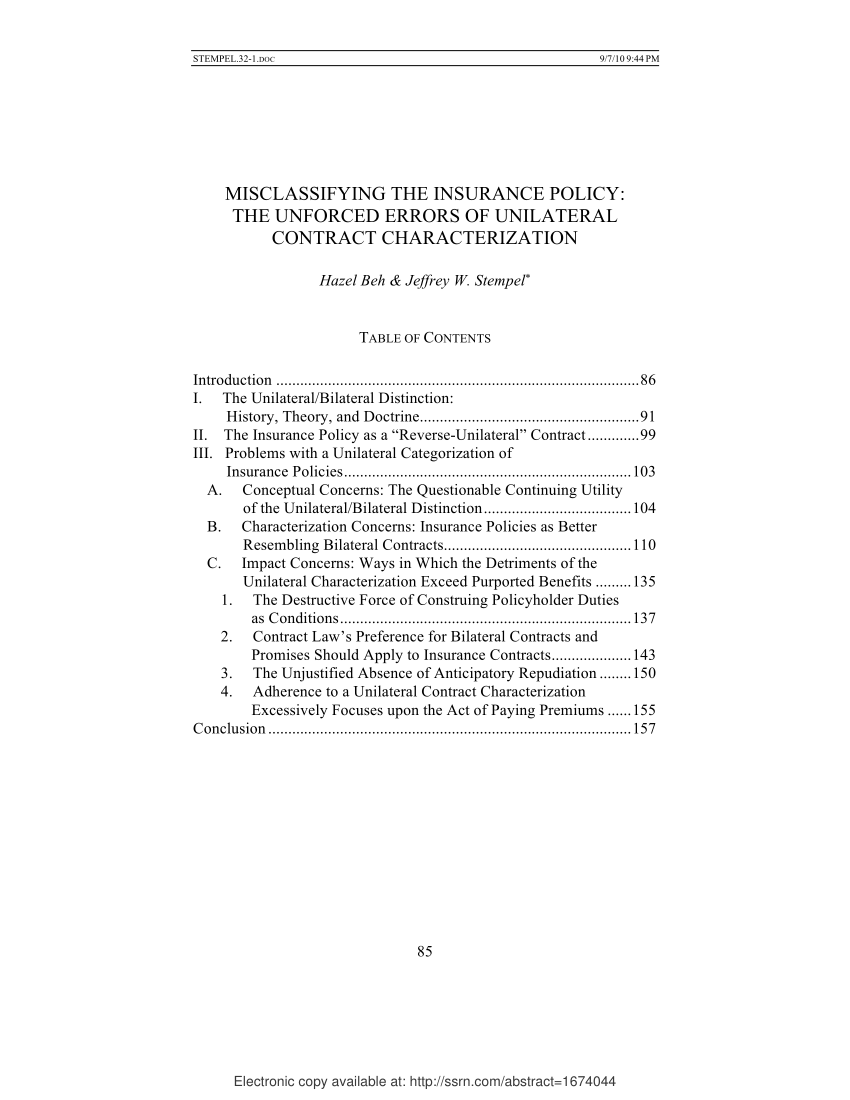

One of the biggest criticisms levelled against the use of standard form contracts is that the contract is one-sided or unilateral and results in. In general unilateral contracts are most commonly utilized when an offeror has an open request for payment for specific conduct. Bob dies 12.

Only the insured pays the premium B. By contrast the insured makes few if any enforceable promises to the insurer. The other party doesnt have the same legal restrictions under the contract.

Standard form contracts also present a unique set of interpretation challenges to judges. Instead the insured must only. Most insurance policies are unilateral contracts in that only the insurer makes a legally enforceable promise to pay covered claims.

In a standard insurance contract the insurance company promises to provide coverage against losses while the insured does not make any promises. The offeror is the sole party having a contractual responsibility in a unilateral contract. A bilateral contract is essentially an agreement between two or more parties binding all of them to reciprocal obligations.

What makes an insurance policy a unilateral contract. One of the biggest criticisms levelled against the use of standard form contracts is that the contract is one-sided or unilateral and results in the insurer wielding disproportionate power to impose unreciprocated obligations on the insured.

Unit 1 Lesson 4 Insurance Policy As Contract Ppt Download

Chapter 7 Insurance Contracts Contract Terminology A Contract

Unit 1 Lesson 4 Insurance Policy As Contract Ppt Download

Insurance 3 Insurance Contract And Insurance Companys Operations

Pdf Misclassifying The Insurance Policy The Unforced Errors Of Unilateral Contract Characterization

Insurance Contract Characteristics Traits Specific To Insurance Contracts Video Lesson Transcript Study Com

2 4 Long Duration Contracts Classification And Measurement

The Characteristics Of Insurance Contracts Pdf Insurance Insurance Policy

2 4 Long Duration Contracts Classification And Measurement

Chapter 11 Insurance Contracts Ppt Download

Appeal For Health Insurance Why Appeal For Health Insurance Had Been So Popular Till N Life And Health Insurance Health Insurance Companies Health Insurance

3 7 Modifications Or Exchanges Of Insurance Contracts

Life Insurance Policy Trust Foundation The Comparative Life Insurance 360 Baloise Vie Luxembourg

Chapter 7 Insurance Contracts Contract Terminology A Contract

Size Charts Jeans Size Chart Wrangler Jeans Jeans Size

Hold Harmless Agreement Templates Free ᐅ Template Lab With Risk Participation Agreement Template 10 Profe Letter Templates Agreement Letter Writing Template

Healthcare Revenue Cycle Management Revenue Cycle Management Revenue Cycle Health Information Management